Minnesota has thousands of small and mid-sized businesses entering the next decade with questions about succession, leadership, and long-term local ownership. That reality was front and center at the Minnesota Carlson Entrepreneurship Through Acquisition Conference, where I have served on the steering committee for the past couple of years and spent the day immersed in conversations with operators, investors, sellers, and lenders.What struck me most was how aligned the ETA movement is with the work we do every day at Security Bank & Trust Co. ETA is not just a niche path for MBAs. It is one of the most important ways Minnesota keeps its businesses locally owned, its communities strong, and its next generation of leaders engaged.

The conference reinforced several themes that readers can apply immediately, whether they attended or not.

The Real Work of ETA: Operational Excellence, Not Glamour

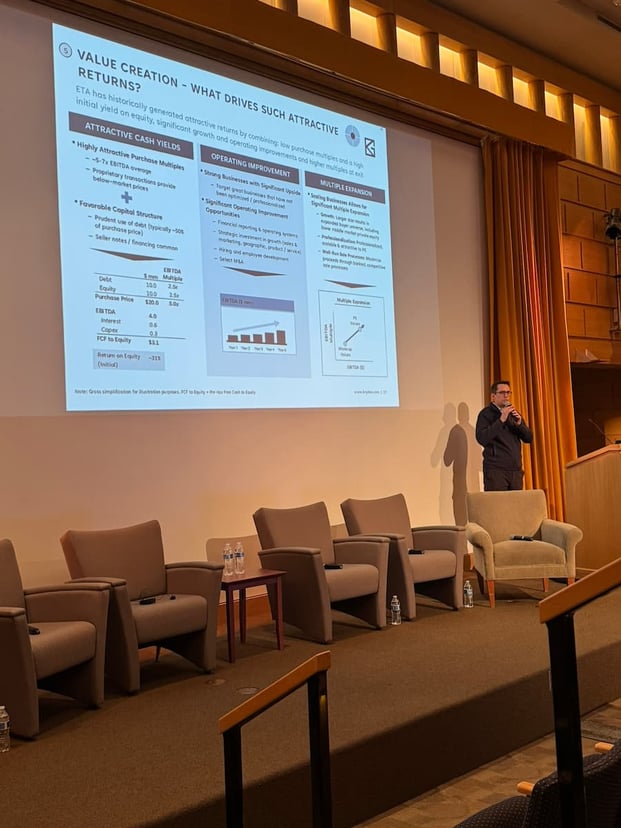

The keynote from Steve Ressler, The Brydon Group, hit on something every future operator needs to hear. ETA is not a finance exercise. It is an operational commitment. You are not buying a spreadsheet. You are inheriting people, culture, habits, systems, and neglected problems.

The returns in this industry have been strong historically because of the financial metrics but driven by the operational chops of infusing talent to grow a small business:

"With a record number of searchers, additional investors, and new classes offered at business schools, activity in the search fund community continues to grow. Adding data from the last two years, returns from all search funds since 1984 fell in line with those reported in recent studies, with a few notable variations. The internal rate of return (IRR) was 35.1%, compared to 35.3% in the 2022 study, and return on investment (ROI) was 4.5x in the 2024 study, down from 5.2x in 2022. Notably, the IRR for companies that have exited increased to 42.9% from 36.8% as several exits in 2022-2023 achieved significant returns." 2024 Stanford Search Fund study

There is not yet enough consolidated data for other ETA paths like independent sponsors or self-funded searches, but the pathway has created economic prosperity for decades. And the operators who succeed share several traits.

Three core ideas stood out from Steve's presentation:

The search process is romantic. The operator’s job is not.

Finding the business will take time and effort. Lots of calls and meetings, false starts and LOIs. The common success stories are driven by individuals that have the grit to keep going, the sales chops to close deals, the intellectual curiosity to solve problems quickly, and the small group leadership experience because leading people is a messy role.

Find an end market that is growing.

The largest returns in the ETA space, particularly the search fund space, were through buying a business with a growing end market. The example provided was Asurion which was a small Roadside Rescue business acquired for $8 million by two 1994 graduates from Stanford. Over the ensuing years, the entrepreneurs morphed itself into a business with over $2 billion in revenues that provides cell phone insurance and earning its investors more than a 100X return. This is obviously an outlier, but the message is the same, find a business where you are selling into growing markets and that will provide more runway for returns.

Explore niche businesses.

Finding niche businesses for sale is not an easy process, but the rewards can be outsized when successful. Niche manufacturers, service lines, technology are all good businesses to consider. Steve provided examples of different types of businesses that entrepreneurs have acquired including:

| Industry | Description | Examples |

| B2B & B2G Services | Sticky, recurring services (often contractual) provided to business and government customers | Continental Fire & Safety, American Security |

| Software | On-premise & SaaS with high degrees of recurring revenue | PlanetDDS, Navegate, & OneShield |

| Healthcare | Primarily healthcare services | Abound, Arosa, & Falcon |

| Home Services | Home services businesses with high percentage of repeat of recurring revenue | Richmond Alarm Company, Hanlon |

The How Sellers, Lenders, and Investors Evaluate ETA Buyers

The conversations around Navigating the Acquisition Process and Financing the Deal: Debt & Equity made something very clear: successful buyers don’t win by rushing to a purchase agreement. They win by bringing real structure and discipline to the front end of the deal. A strong LOI with clear terms and a 90-day exclusivity window sets the tone. It gives you the space to understand the business, pressure-test the financials, and line up the right capital partners without scrambling.

Those ninety days carry a natural rhythm. Early on, you are digging into how the business actually operates and what the seller has built. As you gain comfort there, the quality-of-earnings work helps you understand the durability of the cash flow you’re buying. By the time you reach legal documentation, you should already have a firm grasp of the business, the risks, and the structure you need to close. The sequence matters because it keeps you focused on learning before negotiating.

In the background, you should be working with your lender and equity partners so you’re not surprised by capital structure, covenants, or timing. This is where having a bank that understands succession transitions makes a real difference. And with the amount of capital entering ETA, these partners now influence more of the process than ever before.

One theme that kept coming up throughout the day was seller quality. Operators often underestimate how much the seller’s character shapes the entire trajectory of the acquisition. Sellers who genuinely care about their people and the legacy they built tend to run cleaner operations and make for smoother transitions. If you can show them, honestly, how you intend to protect their team and carry the business forward, you build trust, and trust is often what gets you past the invisible risks that never show up in a data room.

Net working capital was an important topic that sparked a lot of discussion, and for good reason. If you don’t plan it correctly upfront, you pay for it later. Getting it right in the LOI, tightening it in the purchase agreement, and having a plan for cash in those first months is non-negotiable. I’ve always believed you manage liquidity before leverage. Operators need to know exactly what cash they have to run the business on day one. Clear alignment between buyer and seller on the working-capital target and the 90-day true-up prevents conflict and protects the business at a moment when stability is everything.

Even if you never plan to pursue ETA, understanding how a buyer is evaluated is useful for any business owner.

What sellers want

- A buyer who will protect their employees.

- Certainty of closing.

- Respect for the culture they spent their life building.

What banks want

- Realistic projections, not hockey-stick dreams. Understand the J-curve.

- A borrower who understands their financial statements.

- A plan that prioritizes stability and cash flow.

- Character first.

What investors want

- Transparency.

- Communication.

- Data-driven decision making.

The best operators are not the loudest personalities. They are the ones who listen closely, move with clarity, and build systems that reduce chaos.

Post-Closing Integration Decides Almost Everything

This came up in every panel and breakout. Finding a business is hard. Closing a deal is harder. But integration is where the whole thing succeeds or comes apart. And the lessons apply far beyond ETA, they’re relevant for any business owner trying to improve an operation.

Move With Intent, Not Hesitation

One theme was obvious: waiting rarely helps. If you know a change needs to be made to put the company on the path you expect, make it. Quick wins matter. But action without understanding is just noise. Operators repeatedly emphasized learning how the business really works before you start moving pieces.

Know the Business Down to the Floorboards

Jay Sachetti reinforced this. He asked simple questions that cut deep:

When do invoices actually go out?

How are they collected?

What’s the real process behind the scenes?

Small steps no one notices during diligence can blow up post-close if you don’t understand them. Jay also pushed the idea that operators need KPIs that actually reflect movement. The leading indicators tied to sales motion, operational efficiency, and real returns, and not the generic dashboard everyone uses. The right metrics force clarity, accountability, and improvement.

Don’t Underestimate the Lindy Effect

Reg Zeller brought a helpful counterpoint to the everything is being disrupted narrative. Markets tend to predict that new technologies will obliterate existing businesses. But the Lindy Effect reminds us that what has lasted often continues to last.

Non-ferrous foundries are a good example. People said 3D metal printing would crush them. It didn’t. Why? Ingenuity. Adaptation. Owners who understand their craft and evolve with it. The real story is how legacy businesses reinvent themselves and keep winning.

Customers Don’t Flee Just Because the Owner Leaves

Zack Leonard added something most operators learn through experience. Buyers often assume the previous owner had a magic grip on customers and once they exit, everyone will churn. In reality, switching vendors is painful. Clients stick with you if you meet their needs, communicate clearly, and deliver. Reliability keeps customers far more than personality.

Culture Is the Hardest Work and the Real Leverage

Dipesh Patel and others hammered on culture as the underestimated variable in ETA. You inherit employees who didn’t get a payday, who suddenly want raises, and who don’t know you. And you’re trying to create alignment at the exact moment the company is going through the biggest change in its history.

Dipesh pushes a core value he calls “embrace change,” and he builds communication around it. The larger lesson: culture isn’t about slogans. It’s about getting the team rowing in the same direction, understanding who’s on board, and creating the environment where people believe the business is moving forward.

Why ETA Matters for Minnesota’s Economy

Minnesota has thousands of privately held businesses. Many are owned by founders who are nearing retirement without a defined succession plan.

ETA offers:

- A path to keep businesses locally owned

- Leadership opportunities for the next generation

- Stability for employees and rural communities

- A way to preserve community legacy when family succession isn’t available

This is where community banks play a critical role.

We fund these transitions.

We advise entrepreneurs stepping into ownership.

We help sellers exit confidently.

We understand the markets buyers are stepping into because we live and work in these communities every day.

ETA isn’t just a niche investment model. In Minnesota, it is one of the most important ways we protect the backbone of our local economy.

Practical Guidance for Anyone Exploring ETA or Succession

Even if you didn’t attend the conference, here are actionable steps you can use today:

If you want to buy a business

- Understand your financials inside and out.

- Focus on durable, not “sexy,” businesses.

- Build relationships before you need them.

- Create a realistic, lender-ready plan using our Comprehensive Business Loan Checklist

If you want to sell a business

- Document your processes.

- Identify key employees and retention risks.

- Clean up your financial statements.

- Start conversations earlier than you think.

If you simply want to strengthen your business

- Make your first 90 days of any major change deliberate.

- Invest in systems that create clarity.

- Focus on leadership stability.

- Remember that culture beats strategy

Closing Reflection: Keeping Minnesota Businesses Local

Walking through the Minnesota Carlson ETA Conference confirmed something I’ve believed for years. Minnesota thrives when ownership stays rooted in the communities where businesses were built.

At Security Bank & Trust Co., this is part of our mission. We help entrepreneurs take the next step. We help families transition their legacy. And we help our communities maintain economic strength through thoughtful, well-structured financing and practical guidance. It's why we've been ranked the Best Business Bank in Minnesota and one of the Best Banks in Minnesota.

ETA is not about chasing deals. It is about building something that lasts. And in Minnesota, building something that lasts is how we fuel ambition and support the communities we serve.

Further reading on your ETA journey:

Andy is always striving to create an environment individuals want to work in and others want to work with. As a result, he is proud of how we take care of our clients, employees, shareholders, community, and environment. He works to be honest, transparent, knowledgeable, and reliable. A father of three, he is active with his kids' school and after school activities.