Each year, we prepare for the upcoming growing season. It is a rhythm and routine built over the years. Years of working in the fields, reviewing and repairing equipment, and generating financial reports to understand our farm finances. As we review the results of the prior year, it is a great time to take measure of what went well and what went wrong. One area that can be both stressful and rewarding is grain marketing. Here are our 5 tips to maximize your grain marketing.

Farm Finance Tip One: Understand your Grain Cost of Production

In recent years, technology and data developments allow us significant control and knowledge of our farming operation. Even with all these new developments, the best tip and the one that can be reliably reviewed every year is knowing and understanding our cost of production per bushel, per grown crop.

The University of Minnesota Extension provides annual crop budget tools that review data collected in Minnesota along with a lot of great corn and soybean yield information by Minnesota County. In using this information, we can build and support a crop enterprise budget to help us market grain profitably. Although not in Minnesota, the Illinois Farm Management farmdoc website also has some great budgeting information.

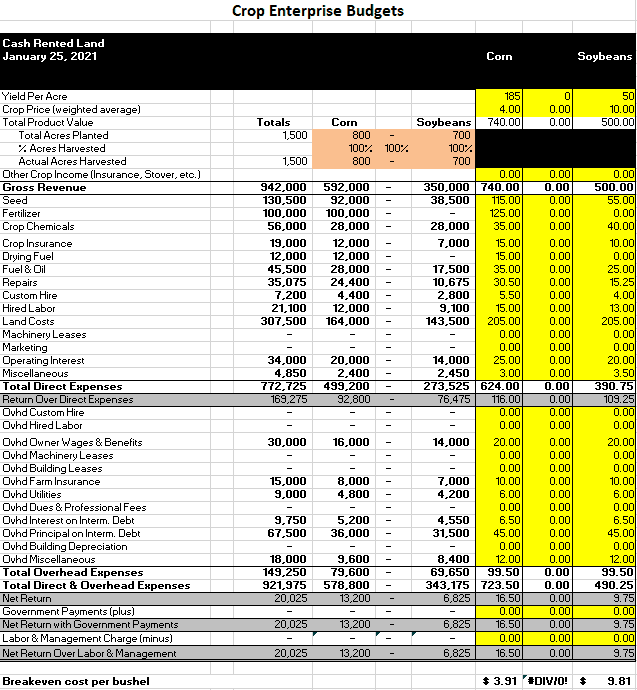

Let’s take a look at an example of what a crop enterprise budget might look like.

Quick Snapshot that Provides Nice Detail

- Breaks Down Crops individually

- Demonstrates what performance can be expected at anticipated prices. By changing prices, we can see how the farm’s profits change

- Understand the direct and overhead costs of production

- Formats by acre so that you can easily compare to Crop Budget information provided by University of Minnesota Extension and your farm’s prior year’s crop enterprise budget

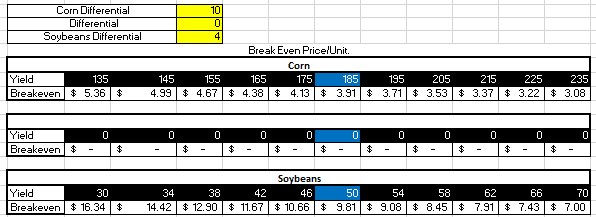

- Break-even cost information that will allow for a more effective crop marketing plan

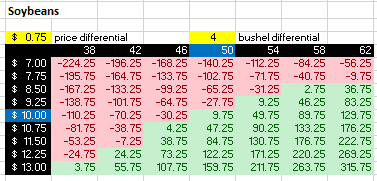

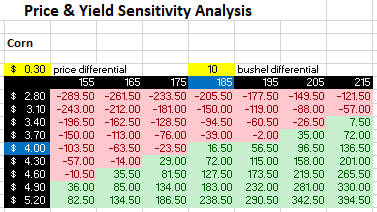

At Security Bank & Trust Co., we use the information provided from our producers to calculate a crop enterprise budget with the cost of production and break-even price for every farm and agricultural business customer as part of the annual review of crop production line of credits. This is a complementary analysis and provides insight on what the break-even price is by corn, soybean, sugar beets, or other crop product and what the sensitivity is to higher prices by market price and yield.

Farm Finance Tip Two: Organize your Grain Marketing Plan into Manageable Sizes

It’s much easier to market our crop when we have a firm handle on crop production costs. The next step is to build a grain marketing strategy that can be simple to execute and limit the emotional swings that come with commodity prices in recent years. An effective strategy is to breakdown the year into more manageable buckets of grain.

For example, the operation above’s corn Actual Production History (APH) is 185. We take this yield times the acres farmed of 740 equals total bushels to sell of 134,900 bushels.

Early in the year, considerations on marketing should include how much of your crop is protected by crop insurance. This allows for protection on overselling the current crop. Often times we see crop insurance at around 80% of the year’s production or 109,520 bushels. A simple target could be to look at bushel sales at increments of 5,000 or 10,000.

After harvest, it is important to review what was actually harvested and compare this to your initial estimates. Further sales in similar increments can be made until the grain sales are complete. Additional considerations should include interest to carry, storage, and any additional costs to carry the crop until sold.

Farm Finance Tip Three: Set Price Targets for Your Grain

A good pricing strategy limits the chance for emotion to drive undue risk. Setting goals for profits on the farming operation provides structure and guideposts to follow as the year progresses and pricing opportunities come forward. There is a seasonality to prices and providing targets and times of year when you want to price crop provides for a structured sales process. Setting these goals and expectations are important to a good grain marketing plan.

As an example, we established earlier we have 109,520 bushels that can be safely marketed for sale pre-harvest. We could break this into sections of 20,000 bushels and review the market opportunities over a five month period. Our break-even price for corn is $3.91 but with Nov 21 cash corn currently trading at ~$4.10 / bushel, we have an opportunity to lock in profitable grain sales. A simple and stable structure could be to set a stop loss level for each month that you want to market (ideally not below the cost of production) and sell at incremental levels of changes in the price. 20,000 bushels could be sold profitably at the $4.10 today and sale orders at either $0.05 or $0.10 price movements at your previously established increments of 5,000 bushels to achieve your overall profit goals.

Selling above crop enterprise break-even is better than selling above cash flow break-even. There is a material difference in that the break-even to cost of production will result in stronger cash flow. You could be selling at cash flow break-even but selling at a level that is less than your cost of production break-even.

Farm Finance Tip Four: Manage Your Basis and Keep Contracts Simple

Basis is the spread between the local cash price and the futures prices. It is a reflection of the current supply and demand in the market. It can fluctuate throughout the year and it impacts the cash received at settlement. The basis gets subtracted or added to the corn futures when a contract is settled. In most cases, the basis is subtracted from the grain price. It’s worthwhile to manage your basis by reviewing the local market’s basis’s impact on the cash price.

Another recommendation is to keep contracts simple for your farming operation. We know that contracts can be as complex as you want them to be and there is a purpose for each type of contract. It can be more beneficial to keep contracts structured on simple terms. We’ve established the importance of having size, price and basis management reviews so the next step is not getting overly complex on the final execution. A concern is when a contract complexity undercuts future cash proceeds because price movements result in future crop getting sold at prices below the current market and break-even price targets. As grain pricing has increased in volatility in 2020 and 2021, it is certainly something to monitor and implement actions into your grain marketing plan accordingly.

Farm Finance Tip Five: Write Your Plan Down and Share with Someone

Documenting a plan is a good way to hold yourself accountable and improve on the plan in the coming year. It follows the idea of a S.M.A.R.T. goal:

- Specific: Well Defined, clear, and unambiguous

- Measurable: Specific criteria that measures progress toward accomplishing the goal

- Achievable: Attainable and not impossible to achieve

- Realistic: Within reach, realistic, and relevant

- Timely: With a clearly defined timeline, starting and ending date so that a sense of urgency is created

By writing it down, your grain marketing plan is organized in an actionable way. If you share this with a friend, family member, spouse, commodity expert, and/or your banker, you can get valuable feedback and additional thoughts on how to execute your plan throughout the year to ultimately achieve your profit goals.